Are others building anything similar to this?

In short, no. While others are building technology using the cloud, the similarities end there.

In recent years, pressure to go to market quickly with a separate digital brand or a one-off offering led some financial institutions to deploy a cloud-native “side core.” Side cores are not full-service cores. They cannot run your entire financial institution. Also, because side cores are not integrated with your primary core, they add complexity, operational fragmentation, and technical debt, requiring separate teams, separate compliance, and separate security management.

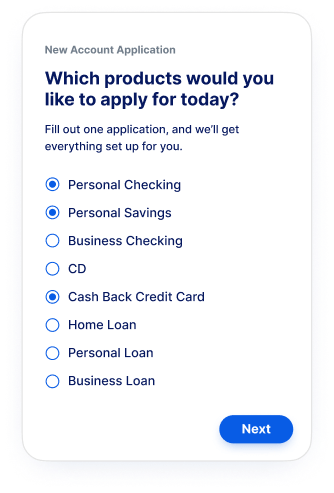

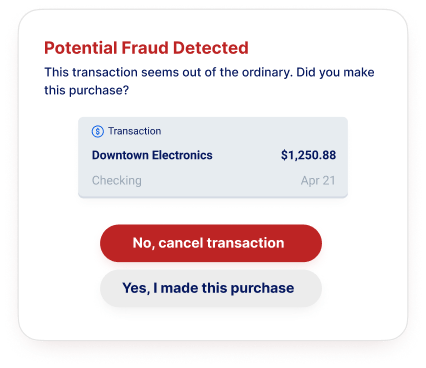

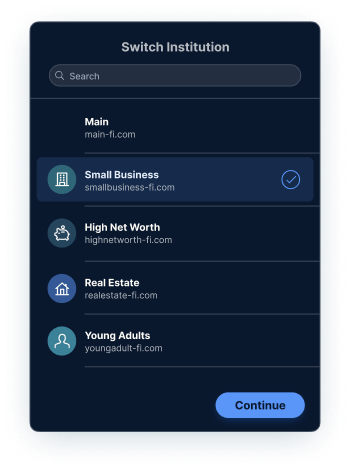

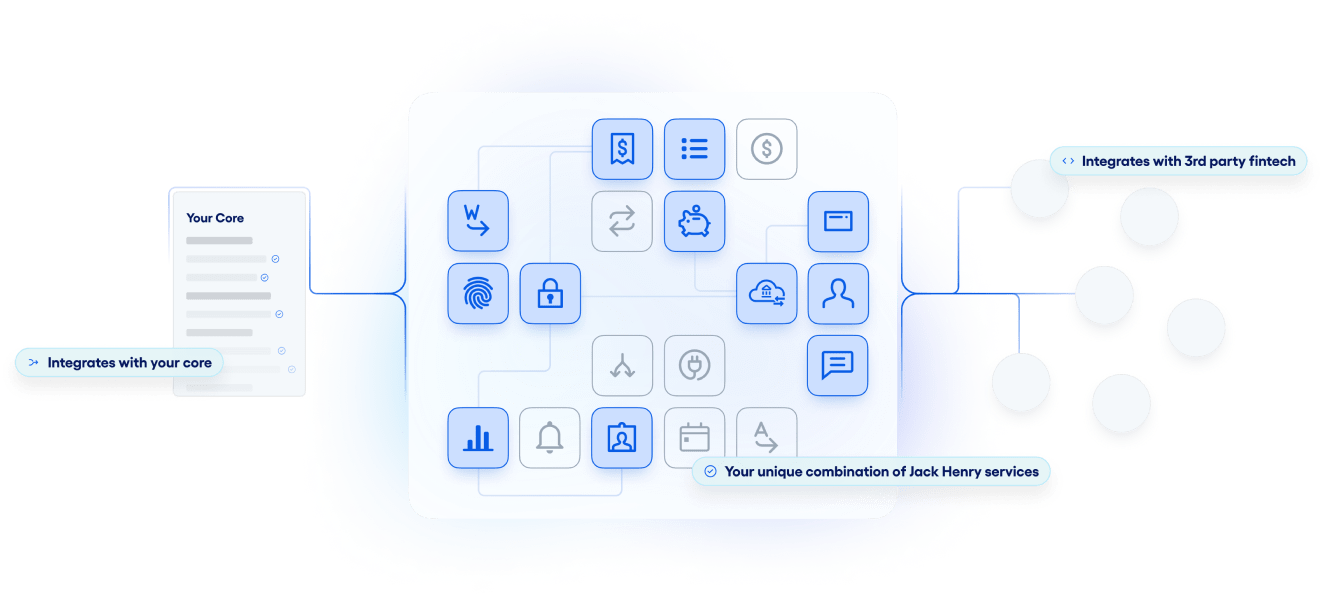

Jack Henry Platform is not just a “cloud core,” but rather an all-encompassing, flexible portfolio of cloud-native, api-enabled services that can be used together in almost-infinite combinations along with third-party fintechs, modernizing existing core functions like wires, and innovating new functions, like pre-processing real-time fraud detection and interception.