While rate movement has been rather stagnant in recent years, times are changing.

Rates are on the move, and with that comes a renewed focus on Asset Liability Management (ALM). As reported by American Banker and National Credit Union Administration, there has been a significant swing in deposit rates, with even more change on the horizon.

According to the latest research from Cornerstone Advisors, the optimist executives at mid-sized banks and credit unions now outrank the pessimists, 55% to 43%. This is good news for our industry. But there are still challenges.

On one hand:

And on the other:

These industry sentiments are a great representation of the yin and yang impacting ALM today.

Although it’s good news that rates are up for the asset side of the balance sheet, they are also up on the liability side. Compound that with the potential for credit deterioration, rising delinquency rates, and sudden hot money deposit moves, and the new reality becomes clear. There is more interest rate sensitivity to consider now than at any point in the past few years.

The latest survey results of bank and credit union CEOs also indicate that growing deposits and improving operational efficiency will be top priorities through 2023 and 2024.

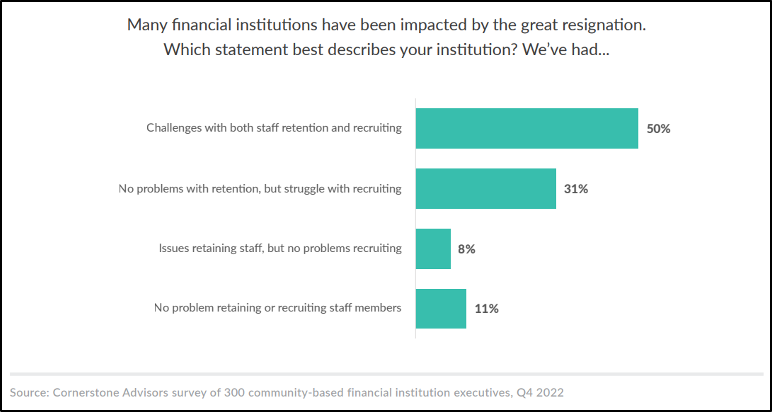

For both banks and credit unions, the interest rate environment is the most frequently cited concern for 2023, quickly followed by the ability to attract talent. Staff retention and recruiting is also a real struggle. Even though much of this challenge involves front-line staff, there is a trickle effect that impacts everyone’s scarce resources.

In addition to the Cornerstone Advisors survey chart above, the 2023 Strategic Priorities Benchmark Study from Jack Henry found that:

CEOs have ranked net interest margin (NIM) a top-three concern for each of the last three years (2021-2023), yet other priorities have shifted. In 2021, CEOs’ main concerns focused on fraud and security and failure to innovate, driven by the pandemic’s mandate for digital-first transformation. In 2022 and 2023, their top concerns were talent acquisition and retention, that is, having the people necessary to drive digital transformation in all its forms.

When asked about their top concerns, CEOs report talent acquisition and retention (45%), economic slow-down (43%), deposit attrition and displacement (43%), and NIM compression (41%).

The collapse of Silicon Valley Bank (SVB) earlier this year certainly accelerated deposit churn. Meanwhile, the launch of Apple Card's new high-yield savings account has added even more urgency for banks and credit unions to strengthen existing deposit relationships and grow deposits by acquiring new accountholders.

Today, the best deposit strategies are targeted, tiered, segmented, and strategic.

High-performing institutions not only price deposits strategically, but they also get creative with the old tools of CDs and savings accounts. For example, they’ll offer refinancing of CDs mid-term or create hybrid bundles that better balance your liquidity and help satisfy an accountholder’s desire for a marginally better rate.

And when it comes to talent acquisition, last year’s recession fears and rising interest rates tightened fintechs’ access to venture capital and prompted mass layoffs. This year, the collapse of SVB accelerated tech layoffs, giving you an even larger pool of talent from which to recruit. Many tech workers are now looking for the stability that chartered financial institutions offer.

In the current environment, outsourcing can be a great mechanism to align your approach with the key objectives of asset liabilities management. Here are the top reasons to consider outsourcing:

With Jack Henry's custom ALM Reporting Service, your assigned analyst can run multiple what-if scenarios to stress test both sides of the balance sheet, evaluate income statements, and gain other situational analysis. Using the proven experts at Jack Henry – who are completely objective and 100% dedicated to ALM – you can free up your limited time to focus on other critical business.

Ever wonder what others are doing? Jack Henry’s portfolio of clients is nationwide, which allows our ALM experts to have a pulse on what’s being asked and share insights to help you become more strategic and informed.

Optimist or pessimist … talk to us today if you could benefit from proven guidance with your Asset Liability Management process.

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are