In the fall of 2019, I wrote a white paper about recessionary trends and the likely end to the longest expansionary period in U.S. history, where I encouraged bankers to focus on assessing the risks in their portfolio. Specifically, I advised focusing on credit, interest rates, and liquidity – the three most significant risks to portfolios that have been at the root of most bank failures in the nearly 100 years since the Great Depression.

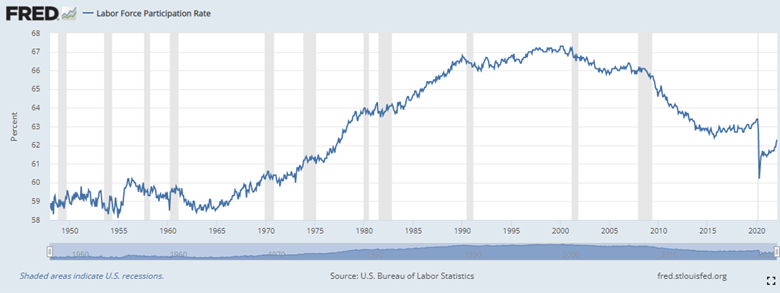

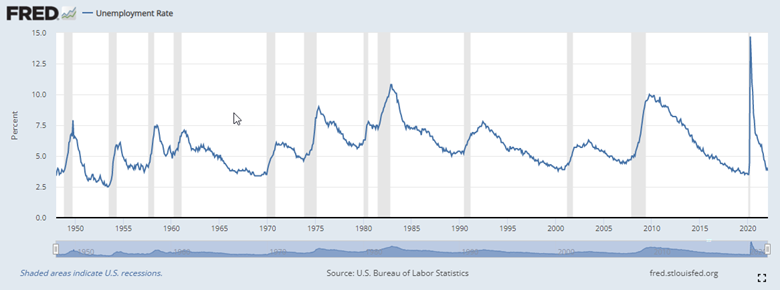

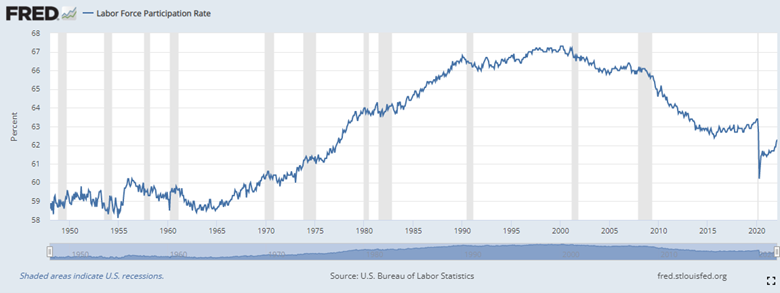

When I wrote that piece, I had no inkling that the next 24 months would bring what has likely been the bumpiest economic ride in U.S. history. We’ve since seen a pandemic, supply chain issues, the Great Resignation, wild employment swings (from 3.5% to 14.2% then back down to 3.8%), the lowest labor force participation rate since the mid-1970s, the Fed’s raising of interest rates (March 2022) and, most concerning of all, the recent war in Europe. There will always be unknowns and challenges, but the amount of change in the past couple of years has been extreme and shows no signs of slowing!

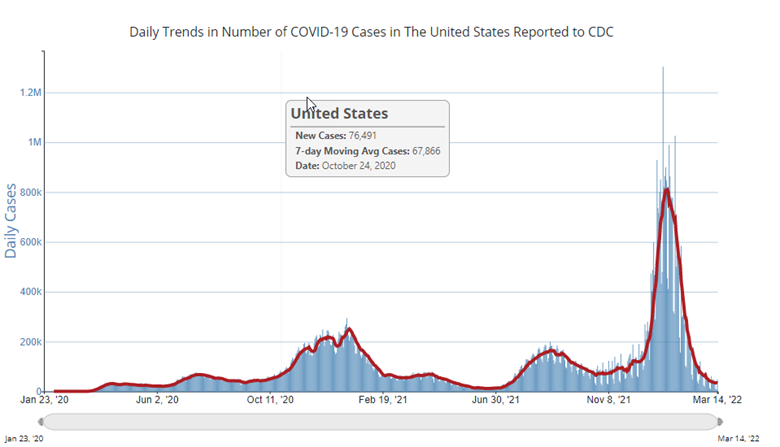

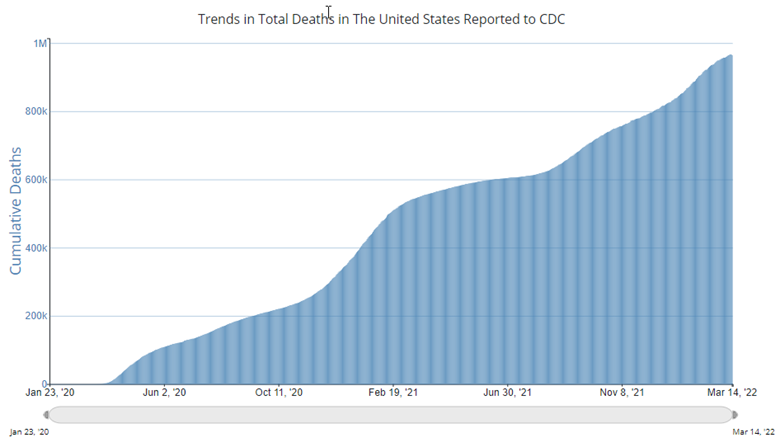

Below are some key economic recession trends with charts to illustrate recent events and provide context.

From its onset in early 2020 to today, we’ve seen several surges/variants and almost one million American deaths due to the pandemic.

We’ve swung from the shutdowns of 2020 to nearly full job recovery in just two years.

Between COVID-19 concerns and the Great Resignation, we now have the lowest labor force participation rate since the mid-1970s. As a result, it is now difficult to find and retain talent (as discussed in my recent blog post.)

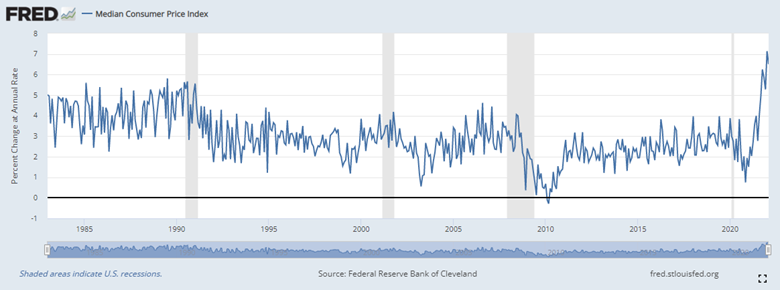

Inflation has jumped to 8.5% as of March 2022, the highest it’s been in 40 years. To combat this disturbing trend, the Fed raised rates by 25 basis points in March 2022 – the first increase in rates since 2018. Then on May 4, 2022, the Fed raised rates by 50 basis points and also announced plans to “roll off” trillions of bond holding over the next three years! This combination is their aggressive attempt to curb inflation.

In these dynamic and challenging times, banks must stay focused on risk identification and mitigation, with particular focus on the “big three” risks: credit, interest rates, and liquidity. Boards of directors and senior management at financial institutions must take an active role to:

These four components, derived from an article by the Federal Reserve Bank of Minneapolis, form the basis of an effective risk management program. Now more than ever, banks need strong interest rate, liquidity, and credit risk modeling to stress test against a wide range of economic trends and events to survive these turbulent times.

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are