Many communities, especially in Louisiana, are still in recovery mode from the 2020 hurricane season, and that there’s still a lot of hard work ahead. Our thoughts and well wishes remain with all of those impacted during this very difficult year.

As I reviewed past articles I’ve written on the Atlantic hurricane season and its effect on financial services, I used the word “observations” instead of “lessons learned” because when some of those observations are of the same challenges repeated time and again, I question whether anyone really learned anything from what happened before.

My apologies for the use of one of the most overused words during 2020, but it would be downright reckless of me to not call out 2020 for what it was – unprecedented.

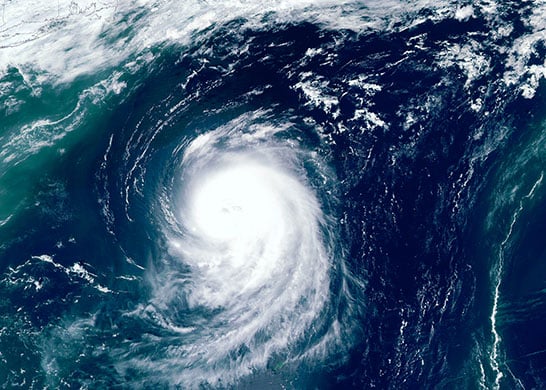

We had three named storms before the season officially started. As we moved through the season, the phrase “the earliest” appeared a lot. Heck, for the first time ever, we had two named storms that hit the same area of the Gulf of Mexico at approximately the same time!

There were so many things that happened during the 2020 season it’s easy to get lost in the many details of each storm. Instead, I want to focus on what commonalities we saw that run from event to event to event. And last years storms don’t even take into account the pandemic and how it complicated recovery and response to each storm. In looking back, three key factors must be considered when disaster hits: people, connectivity, and data.

If you were to ask your employees during non-disaster times if they can be counted on during a disaster – to do whatever necessary to help restore the business – most likely, a high percentage would say yes.

It’s also likely that for many of them, that would be a “qualified yes,” because they have some contingencies hanging on that response. Your employees have questions like, “What about my family and or pets? Where will I stay? Are there adequate provisions like water, food, and medical supplies?”

What about all of that in the middle of a pandemic! Schools, hotels, and restaurants closed. In fact, many places that provided shelters in the past didn’t during 2020. Because of individual state’s pandemic responses, there were different rules and requirements from state to state – and that was the tip of the iceberg.

As each hurricane approached, pandemic or not, what is reasonable to expect from your employees? Customers and members expect access to their money and information about their finances. All of the events of 2020 have only served to amplify that.

Employers who expect their employees to take care of the business have a responsibility to make sure all their employees’ safety and family concerns are properly addressed in advance, even during 2020. Your employees want to do everything they can to help the community and the customers, but they can’t be expected to do so without knowing their family’s needs will be met, and that they will have what they need during a potentially lengthy event, even during a pandemic.

Banks and credit unions must also consider their customers and members. One of the most helpful things a financial organization can do for its customers in times such as these is to implement measures to reduce stress. After all, hasn’t 2020 already had too much of that? During a disaster isn’t the time for a financial organization to be working through these considerations. Ask these questions in advance, and know what your position is going to be:

And, even if you had thought these things through prior to 2020, have other events of 2020 altered what those responses and plans are? As we move beyond 2020, will any of responses revert back to prior positions, as the lengthy, barely started, economic recovery moves on?

Since a number of these solutions involve updates to software settings that are rarely touched following implementation, some advance research of how and what to change can save a lot of time and headache during an already stressful situation.

Almost everything in today’s world relies on access to people and information; and all of that requires connectivity. Smartphones are everywhere and as long as customers and members had them charged, they were trying to use them.

While access to mobile telecom services were interrupted, we saw providers restoring services as quickly as possible. There was also a notable presence of “pop-up” Wi-Fi, some of which was already in place to connect underserved areas due to home schooling during the pandemic.

Unfortunately, we also saw internet service providers (ISPs) wiped out over large areas during more than one hurricane. It took weeks to return any stable connectivity to large areas.

Another consideration here is satellite phones and data access. While this technology is more prevalent and at a lower cost than five years ago, it’s still expensive. But it works well, and if connectivity is required within 24 hours of the passing event, it may be the only option available for a while.

While we’re on connectivity, let’s discuss outsourcing. While this is a great strategy for getting mission critical systems and applications out of your building and under the roof of a service provider, you have to make sure that your recovery strategy addresses how your employees will access these systems during a disaster.

After all, do you want your accountholders to have more access to information and data than your employees do? How are your employees going to service your customers or members if your employees don’t have connectivity to your outsourced solutions?

While people need connectivity, most of that connectivity is leading to systems that need current data in order to remain relevant and available following an event. For those systems that aren’t outsourced, financial organizations need to have a solution in place that replicates their data out of the area multiple times each day. This should be standard operating procedure 365 days a year and not something “special” the bank or credit union does because a hurricane is coming.

Financial organizations must realize that in today’s world, their data is more valuable than the cash they keep in their vaults. Not only are the customers and members expecting that their data will be safeguarded from cyberattacks or data loss, but they also expect their financial organizations to ensure the readiness of that data following an event.

While the customers and members in the immediate impact zone may have more of an appreciation of the challenges, a majority of banks and credit unions will have accountholders outside of the impact zone, who will expect no interruption to their data or the level of service they’re accustomed to.

Last year’s Atlantic hurricane season should serve as a reminder to all that we shouldn’t undervalue the word unprecedented. It’s never happened until it does, and once it does, there’s no guarantee that it won’t happen again, even as soon as the next season.

Whether financial organizations were impacted directly by a named storm in 2020 or not, we must remember that bad things happen on a big scale. The pandemic, civil unrest, social injustice, political turmoil, data breaches, and ransomware attacks aren’t going anywhere just because 2020 is behind us.

The interdependencies between people, connectivity, and data have never been greater than they are today. Customers’ and members’ expectations of their bank or credit union to deliver the services they rely on have never been higher than they are today.

In my 2017 recap article I asked if will it be another decade before we see a punishing storm season? If you recall, 2017 was one of the worst seasons since 2007.

We have our answer; it wasn’t 10 years, it was three. Do you have another three years to properly address your risks and mitigate those gaps, or will the 2021 Atlantic hurricane season, be the one that gets you, your financial organization, and your customers?

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are