Imagine you’ve been commuting to and from work for the majority of your career.

You may work from home every now and then or even once a week, but it’s not the norm. Now imagine a global pandemic hits, and almost overnight – you’re working remotely (likely from home) on a daily basis. Your spouse, kids, and/or pets are probably home during this time, too. Given the circumstance, you might expect more grace and leniency as you’re stretched and challenged more than ever before – especially at work.

Sounds crazy, right? But it’s not ... because this has been the reality for most of us for nearly three years.

Can you relate to any of these scenarios?

As our normal routines and schedules got flipped upside down, we’ve adapted to this new way of working.

On one hand, our physical work environment changed. On the other, we’ve been challenged to innovate while working longer hours and dealing with higher stress levels.

On top of the pandemic and all that came with it – a different work environment, new expectations, and revamped ways of working – came the Great Resignation and quiet quitting.

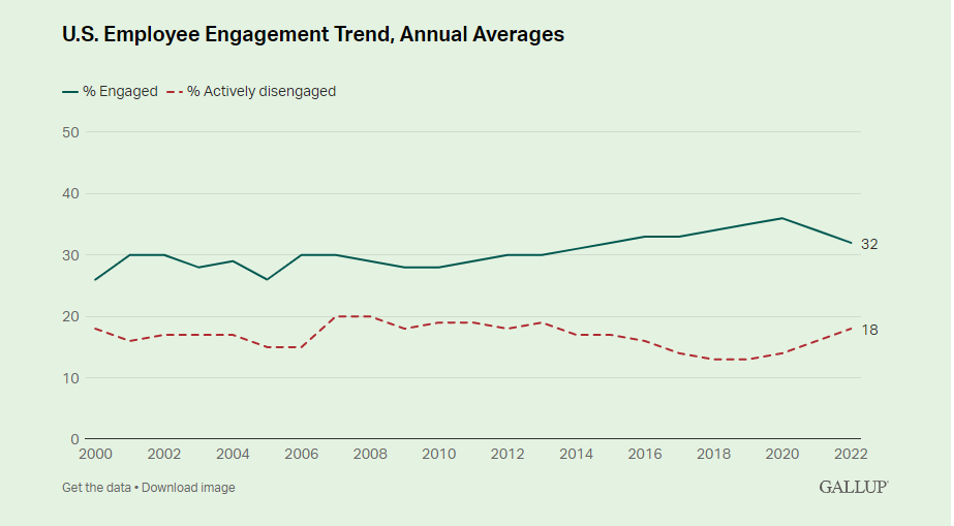

According to Gallup, at least half of all U.S. employees are considered not engaged while 32% are engaged and 18% are actively disengaged.

Employee engagement started declining in the second half of 2021 and decreased even more in 2022, bringing the ratio of engaged to actively disengaged employees from 1.8 to 1 – the lowest it’s been in almost a decade.

In other words, more than half of U.S. employees are quietly quitting – or disengaged at work.

These employees are still performing their job duties, but they’re quitting the idea of going above and beyond like they used to.

There are several reasons why this can happen, some of which include:

The two main driving forces of overall life fulfillment are career fulfillment and relationships.

Going beyond engagement, fulfillment represents more factors that impact employees such as balance, productivity, happiness, and an overall sense of accomplishment.

Not only do we want engaged employees – we want an environment that encourages employees to speak up, take risks, strive for greatness, and find meaning in their work. But our highly remote work environment has made this particularly difficult.

From 2019-2021, the number of people primarily working from home tripled.

Given today’s virtual world, it’s no longer possible to manage employees face to face, observe body language, facial expressions, and overall behavior like you could in an office setting. This can make it harder – and take longer – to get a true feel for employee engagement.

A disengaged worker costs your organization 34% of their salary in lost productivity – making it more important than ever to ensure your employees are engaged, feeling valued and fulfilled, and being recognized and rewarded based on their performance.

How can your bank or credit union reward employees, foster a pay-for-performance mindset, and ultimately combat quiet quitting?

1. determine your corporate priorities

First, establish corporate priorities and communicate those priorities with your entire organization. This will help provide consistency, transparency, and clear direction.

2. create alignment between your corporate priorities and employee responsibilities

Make sure your employees understand their role is directly tied to your financial institution’s outcomes. Be open to answering questions and having conversations to help your employees understand the ‘how’ and ‘why.’

3. set measurable goals for your employees

Recommendations include defining productivity, communicating performance assessment criteria, and detailing what metrics of success look like. Also, ask for employee feedback to better understand what your employees’ idea of fair pay is regarding their daily job demands.

4. monitor performance and reward for achievement

A recent The Financial Brand article states: “To be engaging, pay has to be clearly tied to objective performance metrics that unquestionably achieve … outcomes. If not, money can stir up distrust, dissent, employee competition, and unethical behavior.”

You can monitor and reward your employees based on the measurables determined in step three. Some examples include individual performance, branch performance, portfolio profit, new loan activity, and more.

With the Performance Scorecard solution from Jack Henry™, you can set objectives, view results, and utilize incentive calculations to create an effective, integrated, pay-for-performance program at your organization. By setting objectives and rewarding employees based on performance, it becomes easier to retain top talent, keep employees motivated, and recognize exceptional performers while creating a culture of recognition.

Ready to learn more? Visit jackhenry.com or reach out to your Account Executive today!

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are