First, we much establish what is net economic value, also known as the Economic Value of Equity, is the difference between the fair value of assets and the fair value of liabilities. Economic value of equity (EVE) is a longer term look at interest rate risk. Over the course of the pandemic, with market interest rates at historic lows, fair value of deposits declined. Consequently, EVE finances have declined significantly for most banks and credit unions. It is not uncommon for some deposits to be valued below par in the flat rate scenario.

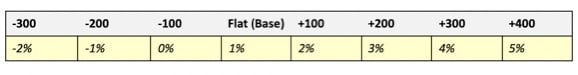

Also causing difficulties for banks and credit unions is the sensitivity of economic value of equity in rate shock scenarios, especially in downward rate shocks. Sensitivity of EVE finance refers to how much EVE changes when interest rates change. In the current interest rate environment, it is not uncommon for EVE sensitivity to fall outside of policy limits in downward rate shocks, sometimes to a substantial degree. It is also not unusual to estimate that economic value of equity will decline 20% or more after a -100 basis point rate shock. The Office of the Comptroller of the Current (OCC) publishes a semi-annual Interest Rate Risk Statistics Report for national banks and thrift banks. The most recent version (Spring 2021) indicates that the median policy limit for change limit for EVE in the -100 rate shock scenario is -10%.

When an important EVE risk management measure falls outside of policy requirements, most policies requires some action by management to correct the situation or manage the policy exception. However, given the low rate environment, available options to correct this type of policy exception are usually limited. So, how can this situation be explained to the Board of Directors? Or to bank and credit union examiners? If there are few, if any, options for corrective action, how can management reassure the Board that appropriate EVE risk management measures are implemented?

Absent any available and appropriate corrective action measures, the best course is to provide increased levels of information to show mitigating factors. Here are some ideas:

Both bank and credit union examiners appear to be showing some patience with out-of-policy EVE results in downward-rate shock scenarios. But it’s always a good idea to remain proactive in managing this risk. Increasing stress testing and other types of analyses noted above can provide valuable contextual information to demonstrate that Economic Value of Equity policy exceptions does not constitute undue risk to the capital of your organization.

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are