The events of the past year have reinforced the notion that healthy loan portfolios feed much more than the financial institution and its shareholders. They feed the communities served by those institutions. They nurture the nationwide economy. Most importantly, they help form the conditions that ensure future economic growth.

A loan portfolio is nothing less than a living ecosystem that either thrives or deteriorates based on the health of the loans contained within as well as the community served.

“The shift from products to ecosystems is having a profound impact on the competitive dynamics within the financial services industry. Banks that hope to successfully navigate this shift and position themselves for long-term success need to completely revamp the way they are thinking about digital transformation and focus, first and foremost, on building digital ecosystems for their customers.”

- Alex Johnson, What’s a Digital Lending Ecosystem and Why Should Banks Care? Cornerstone Advisors, August 2021

Banks and credit unions that adopt the ecosystem mindset can help to ensure the creation of a solid foundation for future growth in loans, deposits, and revenue.

While the six-step process of ecosystem management is universal and well documented across virtually all areas of our natural world, this post will discuss how such an approach can help institutions meet their goals for revenue generation, portfolio growth, and credit quality in the years ahead. The post-pandemic era of commerce in our country will no doubt offer new challenges as well as opportunities for lenders. By adopting an ecosystem mindset, lenders can face these challenges and quickly adjust to newly changing circumstances as they arise.

Step 1: Defining goals to establish direction and purpose

Eighteen months ago, few could have imagined the changes to our world that would occur during 2020 and early 2021. The pandemic brought with it the most significant challenge the global economy has faced since the great recession. In early 2020 small business revenues, on average, dropped by more than 50%. Some sectors, such as travel and hospitality, fell even further.

The year also saw unprecedented economic stimulus through initiatives such as the Paycheck Protection Program (PPP) along with direct payments to individuals. As the economy emerged from the worst of the pandemic, we began to see unprecedented economic growth. The United States has not seen GDP expansion greater than 6% in nearly 40 years, yet we are on pace to exceed that number in 2021.

This roller coaster ride presents significant challenges to institution executives trying to plan for future revenue growth. These plans will no doubt include the best response to aid both consumers and business customers with their own growth plans, understanding that they too have been on the same roller coaster. Loan demand is one example. In 2020, business loan demand was down in most industries, as owners were bolstered by nearly $800 billion in PPP loans. Now that those funds have been exhausted, businesses are once again seeking financing for both short- and long-term working capital, equipment and more. Consumer lending, on the other hand, was bolstered by widespread growth in housing markets across the country – a trend that continues today.

One key challenge for financial institutions has been the continuing compression of net interest margins. From the first quarter of 2020 to the same time in 2021, net interest margin for banks with assets below $1 billion fell from 3.69% to 3.37%. C-Level executives, many at the helm of institutions that are flush with deposits, must decide on the best approach to manage revenue challenges while meeting market needs.

Another challenge will be addressing credit risk issues that surface in the wake of the pandemic. An area of emphasis here could be changes to office space needs in the coming years, given that so many organizations have permanently shifted to remote workforces. This trend will take time since many of these spaces are locked into long term leases. As those leases expire, the adjustments will be felt in the marketplace. Credit risk could also be challenged as the result of the general economic stresses placed on small- to medium-sized businesses in 2020 and 2021. Lenders must now underwrite new requests and renewals in an environment of weaker balance sheets, at least for many sectors.

Through all of these challenges, financial institution executives must work to ensure that their organizations continue to honor the mandate to serve local communities, to enhance the borrowers’ journey through the lending process, and to manage credit risk. This speaks more to the overriding vision of each institution rather than the operational plan. It defines the trajectory of your organization.

Step 2: Full assessment of resources and capabilities

Once the strategic direction of the institution has been fine-tuned and goals have been established, leaders move to the evaluation stage, creating a capacity assessment. This includes not only existing personnel, but also external capacity that may come from contract employees and third-party vendors. Capacity assessments should also include an evaluation of any potential or planned technical implementations, since new technologies can create significant efficiencies in production. Loan origination systems, for example, can often save anywhere from 30 – 70% on key workflows, thus increasing productivity and opening the door to new revenue.

Across the board, the pandemic impacted digital adoption rates for U.S. consumers. A recent article in The Financial Brand summarizes this acceleration. “COVID-19 accelerated the adoption of technologies in every vertical around the world. Experts in the financial sector estimate the pandemic expedited the trajectory of digital banking solutions anywhere from three to 10 years.”

While such an assessment of capacity is common for financial institutions, the 2021 and 2022 assessments bring challenges we have not seen in prior years. The migration of many institutions to more digital-focused delivery could create significant changes for personnel requirements as the institution expands. The transition of some employees to a permanent remote work environment could also cause changes to the overall capacity measures. In short, some of the changes banks and credit unions made to their plans in 2020 will be permanent shifts in the way they deliver services to both consumers and businesses. Even if the institution did not make sweeping changes to internal operations, the preference of customers for new service delivery channels will likely cause the plan to shift.

When assessing capacity, it is especially important to keep the organization’s most important mission in the forefront of planning decisions. For most lending institutions, the primary focus is to support local economies while doing everything possible to enhance the borrower experience, whether the borrower is a business or a consumer. Of course, the other area of focus is internal, working to ensure the lending journey for your own staff is as rewarding as possible. By focusing on the creation of enhanced experiences, you are helping to ensure successful implementation of your goals and objectives.

Step 3: Examination of decision variables and the decision process itself

Given the magnitude of change banks and credit unions have dealt with during the past 18 months, now is a great time to reassess decisions made in a pre-pandemic environment. C-Level executives and boards might wish to ask the question, “Where do we see our institution in five years? Have we identified emerging market needs that will allow us to fine tune our customer offerings in the areas of consumer, commercial, real estate, and even specialty markets such as agriculture or energy? How can these offerings secure sources of long-term revenue?”

The answers to these questions may lead to other decisions that must be made down the line. This would involve a gap analysis to show where the institution is today and where it sees itself in five years. What services need to be added to fill that gap? Will those be developed internally, or does the institution need to seek outside assistance through vendor expertise? It is only through this process of self-examination that an institution can truly outline the decision variable that exists and begin to develop strategies to close product or service gaps.

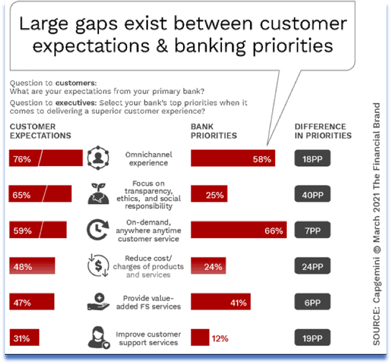

Another recent study in The Financial Brand shed light on some key areas of this gap analysis. As can be seen in the following graphic, the gap between customer expectations and bank priorities is often significant.

Perhaps the most important part of this step is the identification of your key contributors, including both employees and third-party vendors. The determination of decision variables, as well as the decisions themselves, cannot be made in silos. To be successful, they must involve all people that will be expected to manage the outcomes of those decisions. By including them in the process, you are helping to ensure that they are on board for the long haul.

Step 4: Deployment of a strategy to implement decisions

While the process of planning never stops, now is the time to deploy your strategy. In this step, you will widen your scope to include those individuals that will be responsible for executing the day-to-day aspects of your strategy. This process will also include integrations of software or the implementation of new solutions to help meet your goals.

Key milestones along this path must include:

This stage of ecosystem management is where you lean heavily on your top performers and your internal influencers. This is where your team has the chance to excel in the execution of your organization’s vision.

Step 5: Deployment of a monitoring program to evaluate the outcome of decisions and actions

There’s one thing about ecosystems in the natural world that we must consider with this next step. They are always changing. So, to have any hope of success we must constantly monitor the process of creation as it unfolds. This monitoring step is every bit as important as the initial planning and determination stages. Without it, the plan can go off the rails quickly, or worse yet, you can end up with the results you originally planned, but totally miss your mark on what the clients want from your organization.

Step 6: Adaptive management to ensure the defining goals and direction are on track

At some point during the development of any ecosystem comes the time when you must stand back and trust the process. Let those responsible for execution of the plan do their job, while also letting them know that you are ready to support their actions and supply necessary resources to move forward.

Circumstances will always be changing, and those who are successful are the ones who learn to adapt and thrive in their environment even as the ground beneath them is shifting. Of course, the secret is in the knowing. Key visionaries in corporate American history have been those individuals who could think beyond current conditions. By monitoring movements in their environment, they were able to make small tweaks to the plan that often led to big differences in the result. In the end, they may not have ended up where they originally intended, but they ended up where they were supposed to be – based on changes that had occurred in their business since the original planning and decision stages.

As we all emerge from the surreal experiences of the past year, we have the opportunity to move forward with the wisdom gained and the lessons learned. We have the honor of serving our customers and members during a time of economic expansion as they too emerge from 2020. While this is a time of reflection on where we’ve been, it’s also a time of planning to see what we are collectively capable of in the months and years ahead. And the evolution of our financial ecosystem is opening exciting opportunities for us to better serve our customers, members, and employees.

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are