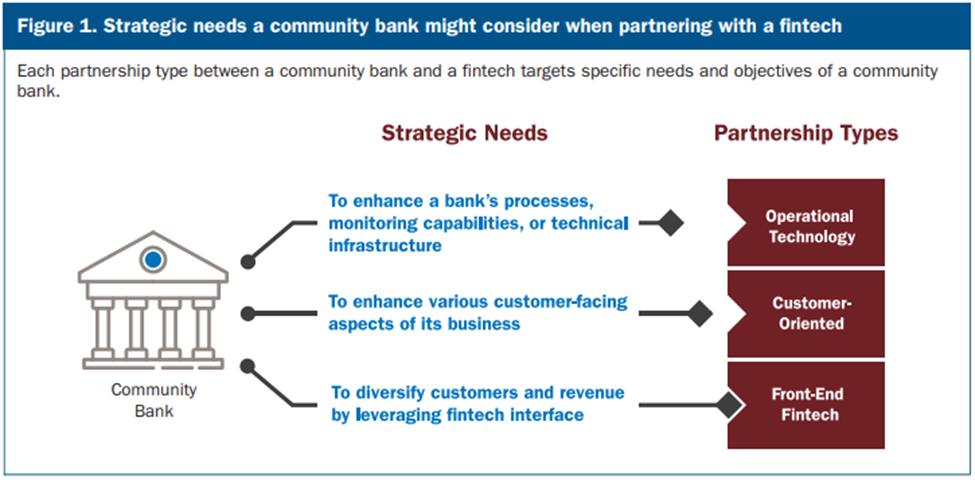

Investments in financial technology have been increasing for years, but the events of the last 18 months have created a new sense of urgency for community banks and credit unions to fine-tune their digital strategies across the spectrum of various fintech investments. A September 2021 publication from the FDIC sheds light on the various reasons community banks have for investing in their digital strategies (shown in Figure 1).

As the FDIC report states, “Community banks that have committed to innovation expressed that their senior management and boards of directors are prepared to make meaningful investments of time and resources in technology. Before making investments in technology, leadership identifies the problem to be solved and the gains they hope to realize from these investments, often using key performance indicators and concrete goals.”

What type of analysis should you conduct? That’ll depend on the nature of the technology you intend to deploy. Is the technology going to bring an entirely new revenue stream to your organization? Or is it intended to save time in the execution of existing service deliveries? Before developing an analysis, it makes sense to pose the following questions to your project management team.

Whether the decision to deploy new technology is driven by market conditions, acquisitions, or some other cause, at some point in your career as a financial professional, you will probably find yourself on an implementation team. Your success in such endeavors will depend on how well you understand the need for the technology and the benefits it can offer to your organization.

You’ll increase your likelihood of success by focusing first on the journey of your clients and your employees through the workflows they are currently managing. By working closely with technology vendors to understand the investments being made and the benefits gained, you will find it easier to support the deployment with senior management in the institution. And by realizing that the conditions are constantly changing, you will be prepared to adjust your strategy as you move forward in time.

Let’s consider two very different scenarios in which you may be asked to calculate ROI for new technology. The first involves an entirely new revenue stream for the organization, while the second involves the replacement of current technologies (or manual tasks) to achieve savings through efficiency. In the revenue generation scenario, consider the following questions as you begin your analysis.

Now consider the deployment of technology for the sole purpose of creating efficiency or improving the effectiveness of your staff in delivering services. How might that analysis differ? Consider the following questions.

The creation of an analysis tool such as an ROI or ROA calculator is possible in either case shown above. The inputs, however, will be quite different since the revenue generation scenario often involves new product offerings from your organization. In either case, your technology vendor should be able to assist in the creation of the models.

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are