Since we started the Jack HenryTM Loan MarketplaceSM in August of 2020, we’ve had conversations with hundreds of banks and credit unions. During each conversation, we ask if they plan to use the Marketplace to buy, sell, or participate loans. Through late February, every organization had the same answer: “We want to buy, buy, buy!”

The combination of government stimulus programs for consumers, businesses, and and banks and credit unions combined with rising interest rates have swollen liquidity in financial institutions to record levels, both of which have negatively impacted opportunities to deploy capital and market returns. Keeping this in mind, banks and credit unions have been actively considering acquiring debt in the form of participations or referrals to quality opportunities.

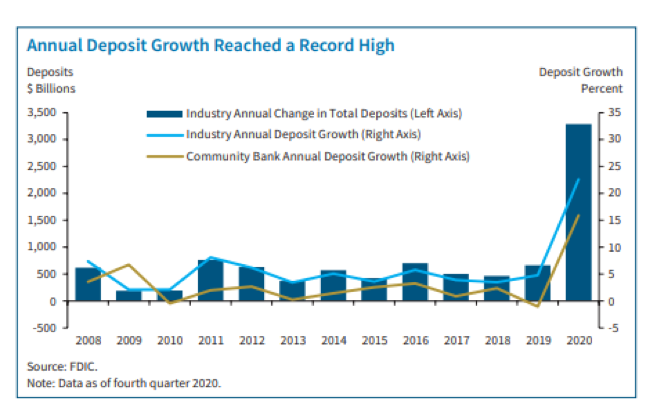

According to a 2021 FDIC Risk Review, “The banking industry saw unprecedented deposit growth in 2020 as increased economic and market uncertainty shifted consumer and business spending and saving behavior. Expanded monetary policy, coupled with government assistance and support programs, including stimulus and unemployment payments and the PPP, bolstered cash for consumers and businesses, which further supported deposit growth and personal savings. Total deposits increased $3.3 trillion, or 22.6%, in 2020, the largest annual growth since 1984 (see the chart below). The influx of cash resulted in increased balance sheet liquidity and decreased reliance on wholesale funding. Community banks mirrored the industry’s deposit growth, reporting a $330.5 billion (18.4 percent) increase in deposits during the year.” These sharp deposit increases put banks and credit unions in a position to redistribute this cash through loans.

Now all the “we want to buy, buy, buy” feedback we received makes sense.

Although most Marketplace users are looking to purchase quality assets, there is a coming shift on the horizon when financial partners will be looking to sell loans and exposure.

We strongly believe this market shift is coming, but pinpointing it will be difficult. Rising interest rates will have an impact and may extend the timeline; however, as banks and credit unions (and regulators) begin assessing loan portfolios in the 2022 Safety and Soundness Exam cycle, they will discover concentrations that need to be diminished or loans that need to go. According to the same article in the FDIC 2021 Risk Review, over the last two years, “Banks remained relatively resilient partly because of government support extended to businesses and consumers most affected by the recession. However, institutions with elevated levels of credit exposure to affected sectors are potentially more vulnerable to market disruptions and could present risk management challenges.” This, however, is changing as payment delinquencies are increasing and credit is beginning to deteriorate.

When a financial institution reduces its concentration in a certain loan segment, it is diversifying its risk in the larger loan portfolio. Diversification is an excellent strategy for a Chief Credit Officer or Chief Lending Officer to pursue proactively before a safety and soundness exam. Take commercial real estate (CRE) for example: CRE has been the most severely impacted loan segment by the pandemic. Until strategies can be implemented to repurpose vacant commercial real estate, this industry will continue to remain uncertain and delinquencies that were originally masked by cash on hand from government programs. In addition, deferrals will begin to cause issues for borrowers, and the banks and credit unions holding that paper. This is just one example; other segments will also feel this shift.

When we take these reasons into account, the most forward-thinking action that you can take is to anticipate the shift in the loan market and utilize the Marketplace as an outlet to sell certain loans (or pools of loans) and adjust to meet the changing dynamics of the financial services industry. The pressure to satisfy regulatory requirements by reconciling loan portfolios while continuing to put cash to work will grow in the coming months. Incorporating diversification and loan participations into your long-term growth strategy presents the opportunity to supplement organic growth while more effectively managing your balance sheet risk. Cloud-based platforms simplify selling and trading, allowing you to manage your loan portfolio more strategically – now and into the future.

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are