One in three consumers (32%) say they will walk away from a brand they love after just one bad experience.

91% of customers who are unhappy will leave a brand without complaining.

89% of consumers have switched to doing business with a competitor following a poor experience.

These figures should make it clear that providing an excellent experience is incredibly important and that accountholder dissatisfaction carries with it a very real risk. Be sure your bank or credit union is not falling victim to any of the following outdated, service-damaging beliefs.

Busted

According to Jim Marous from The Financial Brand, “Speed and simplicity rule. Customers will no longer base their experience perceptions solely on price, product, or convenience. Instead, expectations will be based on digital speed, simplicity and contextuality.”

In fact, a McKinsey & Company survey reported that among first-time home buyers, the most important factor in their decision to choose a lender was learning that the lender delivered an exceptional customer experience.

Even more surprising to some is the reality that 43% of all consumers would pay more for greater convenience and 42% would pay more for a friendly, welcoming experience. And, among U.S. customers, 65% find a positive experience with a brand to be more influential than great advertising.

With data like this, financial institutions can’t expect to compete on rate alone. Providing a fast, simple, convenient, and welcoming experience is paramount to attract and retain today’s accountholders.

Busted

Any institution that competes on relationships and trust is a perfect candidate for open banking.

Financial institutions – no matter their size – need a solid open banking strategy to continue winning share of market and share of wallet. Open banking gives banks and credit unions the opportunity to simplify and improve the banking experience. Institutions can securely embed – inside digital banking – the services users are accessing through different apps today.

But is embedding difficult? Not anymore. The use of open APIs empowers banks and credit unions to integrate solutions quickly and inexpensively. Just look for technology providers with an open strategy and publicly available API documentation.

Busted

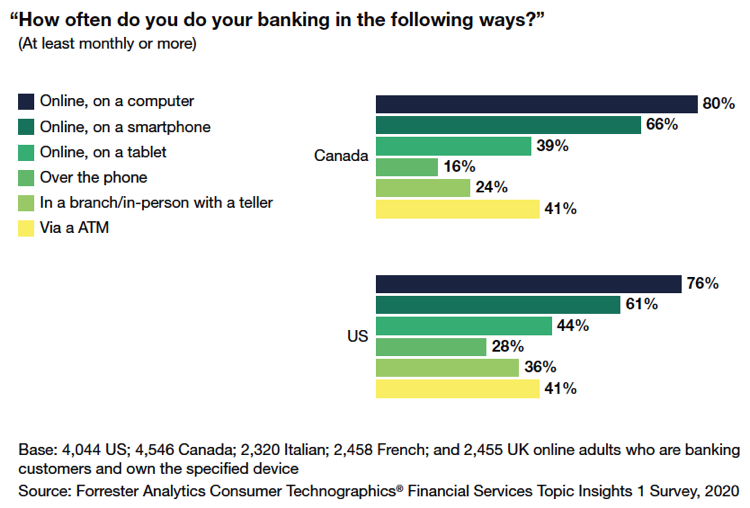

No one can ignore that digital banking adoption has been increasing for years, and the pandemic accelerated this shift. Most banks and credit unions find that accountholders prefer to have options. Over half of respondents to a March 2020 survey from S&P Global indicated that they have been visiting branches less frequently since the pandemic began. However, 36% of survey respondents indicated that they had visited a branch at least once in the 30 days prior to responding to the survey.

Busted

Some lenders fear that automation will drive down customer service. However, if done properly, it has the opposite effect. Automation creates more opportunities to enhance the client experience by saving time in other areas. Think about the typical steps between commercial loan application and closing. Automated workflow communication alone can cut hours or even days from that process.

That time savings gives staff members the opportunity to do what they do best – interact with your clients and prospects. It also gives you a competitive edge and allows you to focus more on relationships and less on process.

Today in traditional banks, the average “time to decision” for small business and corporate lending is between three and five weeks. Average “time to cash” is nearly three months. These times will soon seem antiquated and unacceptable. Leading banks and credit unions have embraced the digital-lending revolution, bringing “time to yes” down to five minutes, and time to cash to less than 24 hours.

A survey from The Financial Brand’s September 2020 Digital Banking Report showed that 85% of financial institutions offer online loan applications. This is a 9% increase from the survey results in 2019. The same report stated that 66% of the respondents supported a complete end-to-end online application, compared to only 52% in 2019.

Digital loan applications are here to stay. Rather than driving digitally savvy borrowers to a fintech or competitor, be sure your institution can retain existing relationships and attract new borrowers.

Busted

While it’s true that older generations show a slight preference for cash and checks, the margins are growing narrower. Recent research from Zelle® shows that 82% of Baby Boomers use P2P platforms to send money to friends and family, as compared to 93% of Millennials. Only 56% of Boomers send money using checks or cash, and 61% of Millennials do the same. In fact, 31% of Baby Boomers said that digital banking apps are now their preferred method of payment, with only 1% saying they prefer not to use them at all.

Rather than assuming older generations have no interest in trying new technologies, focus on educating accountholders about the services available so they can select their preferred payments channels. Doing so is certainly in your best interest, as reducing the number of checks and money orders improves efficiency and lowers costs.

Busted

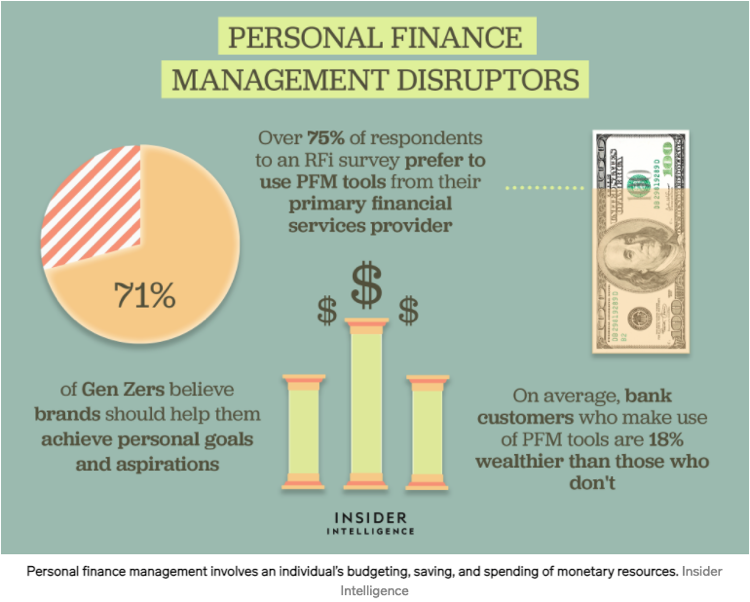

While only a few years ago, adoption plateaued at 10-12% of financial institution users, the adoption of personal financial management (PFM) systems has grown with the advent of fintech apps like Mint, Acorns, and Credit Karma. But that doesn’t mean banks and credit unions should abandon PFM integrations inside their digital banking apps. In fact, 75% of respondents in a recent survey would prefer to use PFM tools from their primary financial service provider than from a separate fintech app.

In addition, bank customers who make use of PFM tools are healthier financially, gaining more wealth than those accountholders not using PFM tools. The opportunity to positively impact the financial health of their accountholders is a relationship-building opportunity no bank or credit union should miss.

Busted

By partnering with ID verification partners that connect to multiple data sources, you can design workflows that make digital account opening simple while still weeding out the bad actors.

In the Digital Banking Report, State of the Digital Customer Journey, it was found that abandonment rates increased significantly as the time to complete an application increased. If it takes over 10 minutes for an online/website process, or five minutes for a mobile process, the abandonment rate impacted the account openings by as much as 40%.”

Fintech competitors using an identity decisioning platform that uses multiple data sources to perform verifications are seeing the benefits of this technology. Novo reduced manual reviews by 50% and doubled their customer conversion. Brex automated over 80% of new account openings, allowing them to move from a private beta of 100 startups to serving thousands of customers in less than six months. And HMBradley was able to automate more than 80% of their customer approvals while minimizing risks and providing a seamless experience for their customers.

The ability to offer digital account opening seamlessly and securely isn’t in the future any longer.

Busted

“71% of Americans would rather interact with a human than a chatbot or some other automated process.”

Digital does not equal impersonal! For example, authenticated, augmented chat allows banks and credit unions to embed personal service inside the digital experience. Accountholders can chat with the same representatives they know and love from their local branch, receive push notifications or alerts when new messages are waiting, and respond at their convenience. In addition, the ability to attach context to a chat through forms, transactions, account lists, and more reduces friction and eliminates the accountholders having to articulate their needs to multiple representatives.

One credit union using core-connected, augmented chat reports that if members can’t make a payment, they are more likely to inform the institution with this tool rather than by phone. “It feels less embarrassing for them,” the CEO notes. It’s another indication that authenticated chat creates less friction in communication.

There are a lot of myths out there... don’t fall victim. A poor experience is more expensive than ever.

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer

Who We Are